Fio mortgage

Do you dream of living in your own apartment or family home with a garden? Don't want to pay rent your whole life knowing that you don't own the property? Or do you want to buy an apartment as an investment for the future? Whatever your reason, we will be happy to help you finance your home.

- We offer free loans, current and credit account management, fund reservations, and loan drawdowns.

For more information, contact our mortgage specialists.

Calculate your mortgage payment

Current discounts

- 0,4 % discount on the interest rate for mortgage refinancing

- 0,3 % discount on the interest rate for property purchase and other purposes according to the price list

The above discounts are available for mortgages up to 80 % of the property value, with a clean credit history.

- 0,2 % discount on the interest rate for payment protection insurance

- 0,1 % discount on the interest rate for loans exceeding CZK 1 million

| Rate type | Rate fixed for 5 years | |

|---|---|---|

| Mortgage amount | from 1,5 mil. CZK | - |

| Refinancing | 4,08 % | 4,18 % |

| Purchase | 4,18 % | 4,28 % |

| Other | 4,48 % | 4,58 % |

We do not currently offer loans up to CZK 1.5 million.

Reduce your interest rate and pay less each month

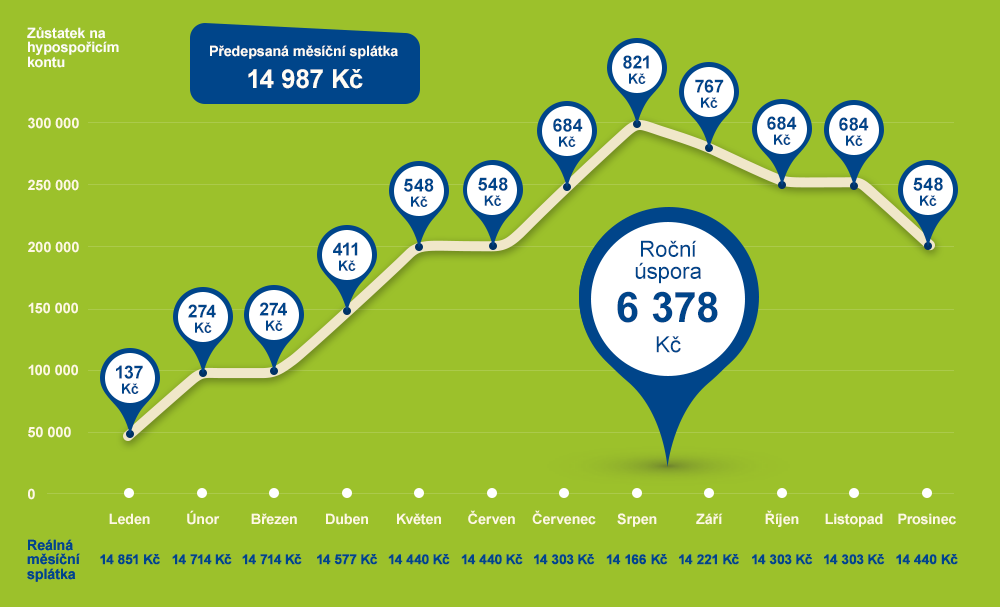

Do you have at least CZK 50,000 saved up? Let them reduce your interest rate and thus your monthly mortgage payments. Your money is available to you at any time, and you can save money every month. Hypospořicí konto is completely free of charge.

A model example will show you how to save with Hypospořicí konto

Calculate your interest rate and monthly payment amount

Are you interested in our mortgage, would you like more information, or would you like to apply for a home loan right away? Contact our mortgage specialists by phone or email. They will be happy to advise you and help you with everything. Or arrange a meeting with them.

If you are unable to contact our mortgage specialist, please fill out the mortgage calculator and leave us your contact details. A mortgage specialist will contact you as soon as possible.

| Město | Hypoteční specialista | Adresa pobočky | Telefonní číslo | |

| Brno | Mgr. Michaela Filipková | Joštova 4 | 224 346 825 | michaela.filipkova@fio.cz |

| Brno | Veronika Konderlová | Joštova 4 | 224 346 814 | veronika.konderlova@fio.cz |

| Brno | Pavel Müller | Joštova 4 | 224 346 824 | pavel.muller@fio.cz |

| Brno | Ing. Martina Šnajdarová | Joštova 4 | 224 346 821 | martina.snajdarova@fio.cz |

| České Budějovice | Ing. Dagmar Štěchová | Dr. Stejskala 110/11 | 224 346 427 | dagmar.stechova@fio.cz |

| Hradec Králové | Ing. Jakub Minařík | Masarykovo náměstí 511 | 224 346 836 | jakub.minarik@fio.cz |

| Jihlava | Barbora Smolíková | Masarykovo náměstí 43 | 224 346 869 | barbora.smolikova@fio.cz |

| Karlovy Vary | Lenka Čekanová | *Vyřídí s Vámi na dálku | 224 346 769 | lenka.cekanova@fio.cz |

| Liberec | Bc. Aleš Urban | Pražská 12/15 | 224 346 881 | ales.urban@fio.cz |

| Olomouc | Jiří Polášek | Slovenská 506/2 | 224 346 399 | jiri.polasek@fio.cz |

| Ostrava |

Bc. Daniela Kavinová | Nádražní 39 (1. patro) | 224 342 739 | daniela.kavinova@fio.cz |

| Ostrava | Ing. Martina Utíkalová | Nádražní 39 (1. patro) | 224 346 339 | martina.utikalova@fio.cz |

| Pardubice | Lukáš Zmij | 17. listopadu 408 | 224 346 842 | lukas.zmij@fio.cz |

| Písek | Lenka Čekanová | Jungmannova 186 | 224 346 769 | lenka.cekanova@fio.cz |

| Plzeň | Bc. Jana Šebellová | Goethova 9/2 | 224 346 980 | jana.sebellova@fio.cz |

| Praha 1 | Bc. Jana Jakešová | Hybernská 1033/7a | 224 346 397 | jana.jakesova@fio.cz |

| Praha 1 | Bc. Jaroslav Joza | Hybernská 1033/7a | 224 346 987 | jaroslav.joza@fio.cz |

| Praha 1 | Martin Lehečka | Hybernská 1033/7a | 224 346 988 | martin.lehecka@fio.cz |

| Praha 1 | Petr Soldán | Hybernská 1033/7a | 224 346 396 | petr.soldan@fio.cz |

| Praha 4 | Ing. Roman Lechner | Nuselská 401/4 | 224 346 497 | roman.lechner@fio.cz |

| Praha 9 | Ing. Tomáš Stolařík | Sokolovská 352/215 | 224 346 406 | tomas.stolarik@fio.cz |

| Praha 9 | Irena Vernerová | Sokolovská 352/215 | 224 346 407 | irena.vernerova@fio.cz |

| Ústí nad Labem | Barbora Doležalová | Dlouhá 3458/2A | 224 342 714 | barbora.dolezalova@fio.cz |

| Valašské Meziříčí | Eliška Plešková | Poláškova 36/4 | 224 346 483 | eliska.pleskova@fio.cz |

| Zlín | Bc. Lucia Šiřinová | Školní 203 | 224 346 905 | lucia.sirinova@fio.cz |

Are you from a different city than where our mortgage specialists are based? They will be happy to provide you with all the information you need by phone or email, and you can then bring the necessary documents to our nearest branch.