Fio mortgage

Do you dream of living in your own apartment or family home with a garden? Don't want to pay rent your whole life knowing that you don't own the property? Or do you want to buy an apartment as an investment for the future? Whatever your reason, we will be happy to help you finance your home.

- We offer free loans, current and credit account management, fund reservations, and loan drawdowns.

For more information, contact our mortgage specialists.

Calculate your mortgage payment

Current discounts

- 0,4 % discount on the interest rate for mortgage refinancing

- 0,3 % discount on the interest rate for property purchase and other purposes according to the price list

The above discounts are available for mortgages up to 80 % of the property value, with a clean credit history.

- 0,2 % discount on the interest rate for payment protection insurance

- 0,1 % discount on the interest rate for loans exceeding CZK 1 million

| Rate type | Rate fixed for 5 years | |

|---|---|---|

| Mortgage amount | from 1,5 mil. CZK | - |

| Refinancing | 4,08 % | 4,18 % |

| Purchase | 4,18 % | 4,28 % |

| Other | 4,48 % | 4,58 % |

We do not currently offer loans up to CZK 1.5 million.

Reduce your interest rate and pay less each month

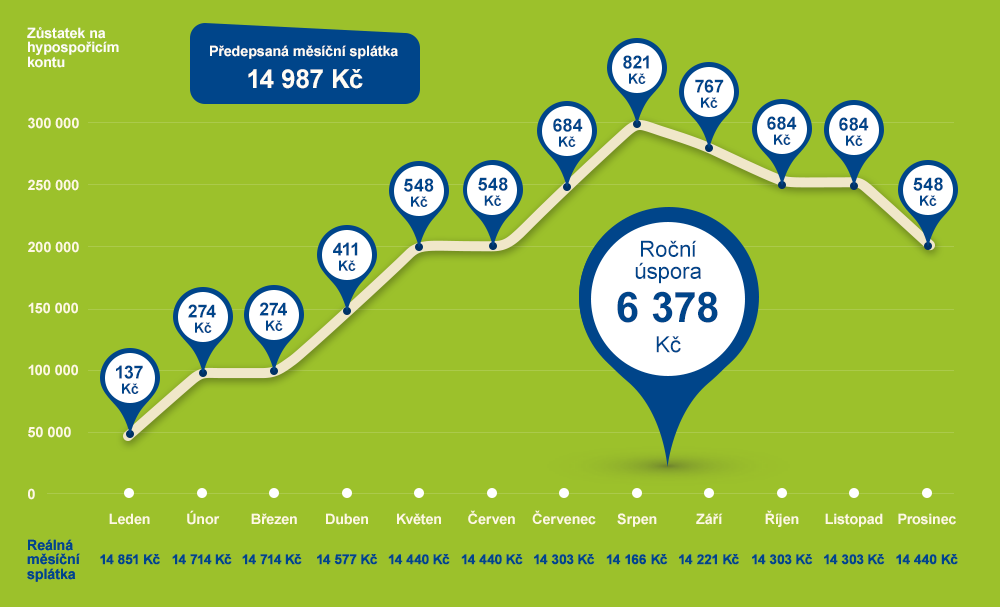

Do you have at least CZK 50,000 saved up? Let them reduce your interest rate and thus your monthly mortgage payments. Your money is available to you at any time, and you can save money every month. Hypospořicí konto is completely free of charge.

A model example will show you how to save with Hypospořicí konto

Calculate your interest rate and monthly payment amount

How to obtain a mortgage

You can get an approximate calculation of monthly payments and interest rates using our mortgage calculator. We will also be happy to calculate the parameters of your mortgage at our branch and provide you with further information.

What will you need? Proof of identity, proof of income, basic documents proving the purpose of the loan, including collateral, and a completed mortgage application. If you need help, we will be happy to assist you at our branch. You can find an overview of all the important documents here.

What do we assess? Your creditworthiness, i.e., your income and expenses, and thus your ability to repay the loan.

If you are an employee and can prove your income from employment, all you need is a confirmation of income and statements from the account where your salary is paid for the last 3 months. If you have income from business activities, we will need your personal income tax return, including attachments, confirmed by the tax office stamp for the last 2 years.

After a positive assessment, your selected property will need to be appraised by an appraiser. If you already have an acceptable market valuation of the property that is less than 6 years old, you can use this for the purpose of "refinancing." Under certain conditions, we can appraise the property ourselves, saving you the cost of an external appraiser. What conditions need to be met?

We will then compile all the documents and finalize the details together so that you can draw down the loan and start repaying it.

What do we include in your income?

1. Income from employment in the Czech Republic or abroad

2. Income from business and other self-employment activities, or concurrent income

3. Income from existing real estate rentals in the Czech Republic

4. Income from other sources, such as parental allowance, old-age pension, retirement pension, etc.

Are you buying a property in a project that we finance?

If you are applying for a mortgage to purchase a property from a development project that we finance, we will take care of everything necessary directly with the developer. All you need to do is provide proof of your income and expenses, i.e., your ability to repay the requested loan. The entire application process will be faster and easier than if you were to apply for the same mortgage at another bank. How can you tell if we finance a development project? Ask our mortgage specialists.